Company law, company formation, transformations Sp. z o.o. in Poland: opportunities, risks and legal requirements

Establishing a limited liability company in Poland: How to protect yourself legally

Sp. z o.o. instead of GmbH – What is the difference between setting up a company in Poland?

Even though the Polish Sp. z o.o. has many similarities with the German GmbH, there are significant legal differences:

• Minimum share capital: Only PLN 5,000 (approx. EUR 1,150), with a minimum share of PLN 50 per shareholder. Founding documents: The articles of association must be written in Polish or submitted in a bilingual version.

• Registration requirement: The company must be entered in the Polish Commercial Register (KRS).

• Founders: Shareholders can be both natural and legal persons; managing directors may only be natural persons.

• Managing directors are not required to be resident in Poland.

Poland allows companies to be established either by a local notary or via the online registration system S24 – the latter, however, only with standard contracts and electronic signatures (e.g. ePUAP or qualified certificates).

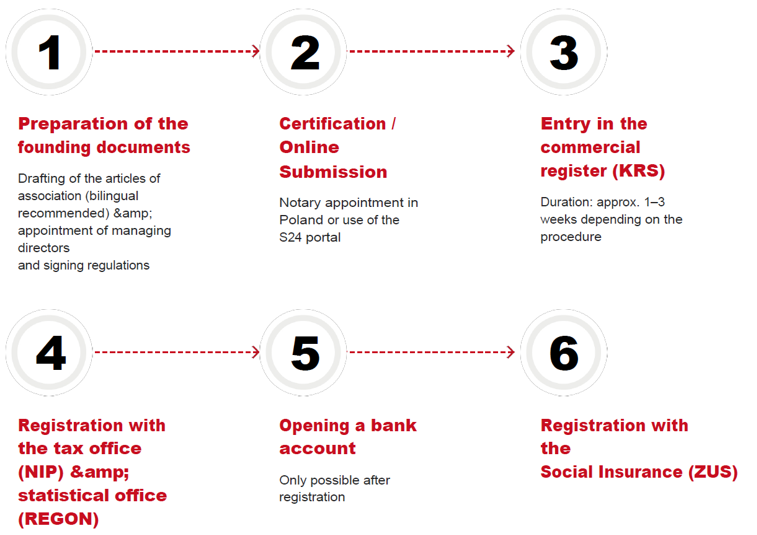

This is how the establishment of a limited liability company in Poland works in practice

A structured process saves time, costs and avoidable queries from authorities:

With good preparation, the entire process usually takes 2 to 6 weeks.

Tax framework for German founders

The Sp. z o.o. is subject to Polish corporation tax (CIT) – currently 19% or 9% for small businesses. Dividend taxation and withholding taxes may also apply. Please note:

• Value added tax (VAT): Applicable above certain thresholds – or on a voluntary basis.

• Avoiding double taxation: The double taxation agreement (DTA) between Germany and Poland allows many tax conflicts to be avoided.

• Transfer pricing & managing director salaries: In the case of close economic ties (e.g. holding structures), tax advice is recommended.

In many cases, it makes sense to consult closely with a German tax advisor – as well as a local accountant in Poland, ideally one who speaks German.

Common mistakes made by German entrepreneurs – and how to avoid them

Despite EU membership and the apparent similarity between the two legal systems, there are a few pitfalls:

• Inadequate appointment of managing directors – for example, without clear representation rules

• Lack of commercial register or tax registration, for example, when importing goods

• Lack of knowledge of Polish formalities – e.g., concerning document certification or powers of attorney.

Legal support not only ensures legal correctness, but also organisational efficiency – especially in the case of digital start-ups or the involvement of several shareholders.

How to legally secure your start-up

A professional start-up not only saves time, but also reduces later risks in terms of liability, management or tax structuring. Specialised legal advice supports you in areas such as:

• Reviewing and drafting the articles of association (including a German version)

• Communication with notaries, authorities and banks

• Preparing all registrations with the Polish Commercial Register (KRS) and authorities

• Support with remote start-ups or online registration

If you would like advice on options for structuring your company – e.g. via a holding company in Poland or a German-Polish GmbH structure – we recommend contacting our law firm's corporate law department.

Conclusion: Successful start-ups in Poland – with the right structure

Establishing a limited liability company in Poland offers entrepreneurs many opportunities – tax, economic and strategic. However, it is crucial to ensure that the establishment process is legally sound and economically sensible.

Those who are aware of the differences to German GmbH law at an early stage and avoid typical mistakes lay the foundation for a successful market entry.