Investment and commercial law SP. Z O.O. EXPLAINED – MEANING, LEGAL FORM, DIFFERENCES FROM GMBH

SP. Z O.O. EXPLAINED – MEANING, LEGAL FORM, DIFFERENCES FROM GMBH

What is a Sp. z o.o.?

"Sp. z o.o." stands for a limited liability company – one of the most common and widely chosen forms of doing business in Poland. It is a type of capital company whose structure in many respects resembles the German Gesellschaft mit beschränkter Haftung (GmbH). The popularity of this form stems mainly from the limited liability of shareholders and relatively low capital requirements.

Legal basis and features of a Sp. z o.o.

A Sp. z o.o. is governed by the Polish Commercial Companies Code (KSH). Its key features include:

• Legal personality – a Sp. z o.o. is a separate legal entity. It may acquire rights, incur obligations, conclude contracts, sue and be sued.

• Shareholders – the company may be established by one or more individuals or legal entities. An exception is the prohibition of forming a single-member Sp. z o.o. by another single-member Sp. z o.o.

• Share capital – the minimum is PLN 5,000, and the nominal value of one share cannot be lower than PLN 50.

• Liability – shareholders are not personally liable for the company's obligations; they risk only their contributed capital.

• Bodies – the basic bodies are the meeting of shareholders and the management board. In larger companies meeting statutory requirements, a supervisory board or audit committee must be appointed.

• Establishment – the company acquires legal personality upon entry in the National Court Register (KRS).

How to set up a Sp. z o.o.?

Registering a Sp. z o.o. in Poland is relatively straightforward and can be carried out traditionally (before a notary) or electronically through the S24 system. The basic steps are:

1. Execution of articles of association – in the form of a notarial deed (or electronically in the S24 system).

2. Contribution of the full share capital by the shareholders

3. Appointing the management board

4. Establishing the supervisory board or audit committee if required by law or the company's articles

5. Registration in the National Court Register (KRS)

Differences between Sp. z o.o. and the German GmbH

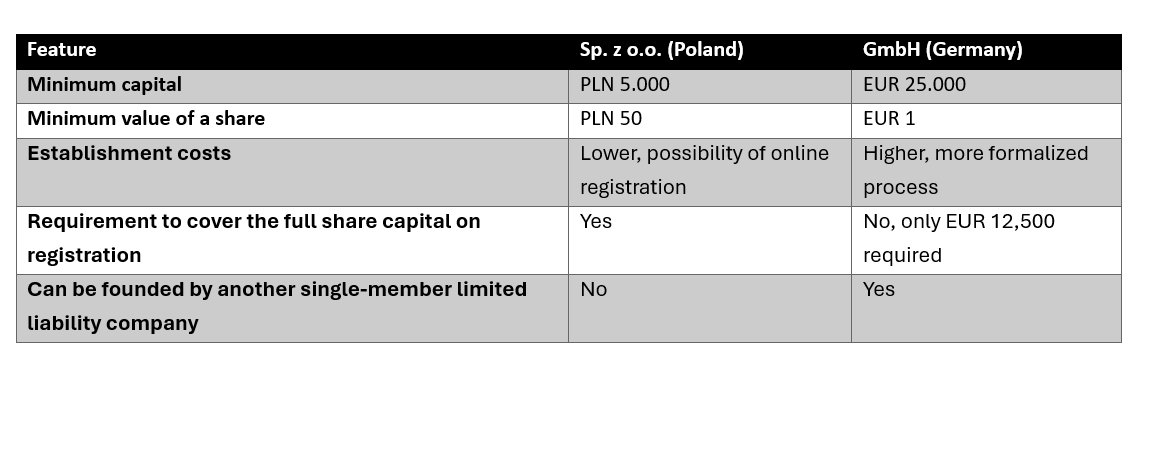

Although both forms are very similar, there are significant differences.

The biggest difference concerns share capital – in Poland, the entry barrier is much lower.

Sp. z o.o. in international practice

For foreign entrepreneurs, including Germans, the Sp. z o.o. is the most frequently chosen form of business activity in Poland. Its structure is familiar thanks to the similarity to the GmbH, while offering more flexible and cost-effective establishment conditions.

Summary

A limited liability company ( Sp. z o.o. ) is the most popular type of capital company in Poland. Its main advantages are the limitation of shareholders' liability, low capital requirements, and a relatively simple setup procedure. Although it differs in details from the German GmbH, the idea remains the same – enabling business activity while offering protection of the shareholders' private assets.