Investment and commercial law The most common mistakes made during debt collection and how to avoid them

The most common mistakes made during debt collection and how to avoid them

The most common mistakes made during debt collection and how to avoid them

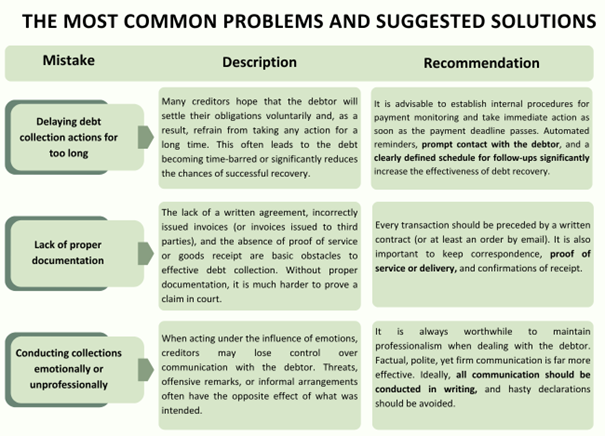

Debt collection is an integral part of running a business. In practice, however, many companies and individuals make mistakes that not only prolong the process of recovering funds but may also result in the permanent loss of the claim.

Below you will find an overview of the most common mistakes made in the debt collection process, as well as practical tips on how to avoid them.

Summary

Avoiding the above mistakes not only allows for more efficient recovery of outstanding debts but also protects a company or individual against financial losses. It is important to remain vigilant, act quickly and professionally, and document every transaction. This way, the debt collection process will proceed more smoothly and with a greater chance of success.