Investment and commercial law Legal forms of running a business in Poland – an overview

Company Forms in Poland – An Overview for Founders and Investors

If you want to start a business or invest in Poland, you first face the question: Which legal form is the right one? Similar to Germany, Poland offers various legal forms that differ in capital requirements, liability, and administrative effort. The choice has far-reaching consequences—from the tax burden to liability.

1. Sole Proprietorship (Jednoosobowa działalność gospodarcza – JDG)

The simplest way to start a business in Poland is the sole proprietorship.

Features :

• Fast and straightforward registration.

• No minimum capital requirement.

• Full control by the founder.

Advantages :

• Low start-up costs.

• Simple administration and bookkeeping.

• Particularly suitable for freelancers, the self-employed, or small retail businesses.

Disadvantages :

• Unlimited personal liability.

• Less attractive to investors.

• Limited scalability options.

________________________________________

2. General Partnership (Spółka jawna – sp.j.)

The Polish General Partnership roughly corresponds to the German OHG.

Features :

• Formed by at least two partners.

• No minimum capital required.

• Contractual arrangement between the partners.

Advantages :

• Flexible structure for small businesses.

• No strict capital requirements.

• Easy formation and administration.

Disadvantages :

• Partners are personally and jointly liable.

• Less professional image than corporations.

________________________________________

3. Limited Partnership (Spółka komandytowa – sp.k.)

Limited Partnership is a hybrid form offering interesting structuring options for founders.

Features :

• At least one general partner (unlimited liability) and one limited partner (liability limited to the limited partnership sum)

• Popular for family businesses or small groups.

Advantages :

• Possibility to limit liability.

• Flexible ownership structure.

• Partly tax-attractive for smaller companies.

Disadvantages :

• More complex contractual arrangements required.

• Limited attractiveness for international investors.

________________________________________

4. Limited Liability Company (Spółka z ograniczoną odpowiedzialnością – Sp. z o.o.)

The Polish equivalent of the GmbH (Sp. z o.o.) is by far the most popular form for founders and investors.

Features :

• Minimum share capital: PLN 5,000 (approx. EUR 1,100).

• Liability limited to the company’s assets.

• One or more shareholders are possible.

Advantages :

• International recognition and EU compatibility.

• Clear limitation of liability.

• Suitable for SMEs, start-ups, and investors.

• Option of online establishment (S24 system).

Disadvantages :

• More demanding accounting obligations.

• Formation somewhat more complex than for partnerships.

👉 For German entrepreneurs, the Sp. z o.o. is the standard choice, as it combines legal certainty, tax advantages, and flexibility.

________________________________________

5. Public Limited Company (Spółka akcyjna – S.A.)

The Public Limited Company corresponds to the German AG and is particularly suitable for large companies or investors with capital market ambitions.

Features :

• Minimum capital: PLN 100,000 (approx. EUR 22,000).

• Strict organizational requirements (e.g., supervisory board).

• Suitable for IPOs or large financings.

Advantages :

• Access to capital markets.

• High credibility with investors and partners.

• Clear structures for large enterprises.

Disadvantages :

• High capital requirement.

• Complex formation and administrative processes.

• Less suitable for small founding teams.

________________________________________

6. New Legal Form: Simple Joint-Stock Company ( SJSC )

Since 2021, Poland has offered the Simple Joint-Stock Company, a flexible legal form designed specifically for start-ups.

Features :

• Minimum capital: only PLN 1.

• Fast online incorporation possible.

• Flexible participation structures for investors.

Advantages :

• Very low entry barriers.

• Attractive for founding teams with investor participation.

• Ideal for technology-oriented start-ups.

Disadvantages :

• Still relatively new and therefore less widespread.

• Less law practise and market experience.

________________________________________

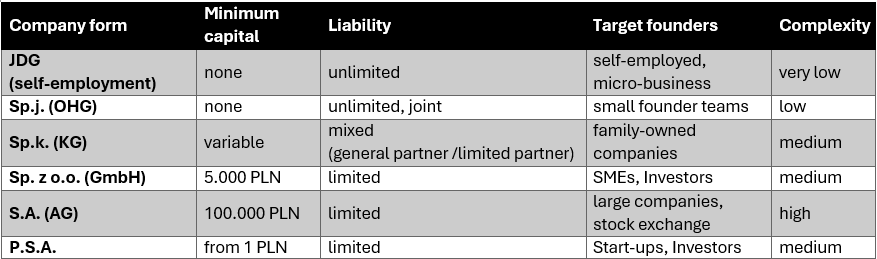

Comparison of the key legal forms of companies

Conclusion: Choosing the right legal form of business in Poland

The choice of legal form depends heavily on the entrepreneur’s objectives:

• For small entrepreneurs and freelancers, a sole proprietorship often suffices.

• Those wishing to limit liability risks tend to opt for a Sp. z o.o.

• For start-ups with investor participation, the P.S.A. is a modern alternative.

• Large capital projects usually rely on the S.A.

Especially for international entrepreneurs, Poland offers a flexible environment: from lean incorporation to complex holding structures, many options are available.

Company forms in Poland – an overview for founders and investors

Anyone looking to establish a business or invest in Poland faces a crucial question at the outset: which legal form is the right one? The choice affects not only set-up costs and administration, but also liability, tax treatment, and attractiveness to investors. Poland offers a broad range of company forms that are similar to German structures but differ in important details. Below is an overview of the key options and what they mean for founders and investors.

Sole Proprietorship (Jednoosobowa działalność gospodarcza – JDG) – the fast track

The Sole Proprietorship, in Polish “jednoosobowa działalność gospodarcza” (JDG), is the simplest and quickest way to start doing business in Poland. It requires no share capital and can be registered with minimal fuss. It is particularly suitable for freelancers, small traders, and founders who wish to start with low risk. The major drawback: the owner has unlimited personal liability, which makes the JDG less attractive for riskier business models.

General Partnership (sp.j.) – entrepreneurship as a team

The General Partnership (sp.j.) roughly corresponds to the German OHG. It is established by at least two partners under a partnership agreement. No minimum capital is required, which facilitates entry. This form is popular with small founding teams who want to share responsibility. However, the partners are personally liable on a joint and several basis, which increases risk. It is therefore usually less appealing to investors.

Limited Partnership (sp.k.) – a flexible structure for family businesses

The Limited Partnership (sp.k.) is a hybrid form requiring at least one general partner and one limited partner. While the general partner has unlimited liability, the limited partner’s liability is capped at the amount of their limited partnership contribution. This provides a degree of security and flexibility, for example, for family businesses or medium-sized enterprises. It is less common among international investors, as the structure is more complex and does not project the same professional image externally as a corporate vehicle.

Limited Liability Company (Spółka z ograniczoną odpowiedzialnością – Sp. z o.o.) – the most popular legal form

The Limited Liability Company (Spółka z o.o.), Poland’s equivalent of the GmbH, is the most frequently chosen legal form in Poland. With a minimum share capital of only PLN 5,000 (approx. EUR 1,100), it is markedly cheaper to incorporate than a German GmbH. Liability is limited to the company’s assets, which makes it particularly attractive to founders and investors alike. The Sp. z o.o. suits both small start-ups and international groups, establishing a subsidiary in Poland. It offers legal certainty, flexibility, and a clear external profile—qualities that make it the standard choice for many entrepreneurs.

Public Limited Company (Spółka akcyjna – S.A.) – the form for large investments

The Public Limited Company (S.A.) corresponds to the German AG and is suitable above all for large companies and capital market projects. It requires a minimum share capital of PLN 100,000 (around EUR 22,000) and a complex governance structure with a supervisory board and general meeting. Its advantages lie in access to capital markets and high credibility with investors and business partners. For founders of small and medium-sized enterprises, however, the S.A. is often too demanding and capital-intensive.

Simple Joint-Stock Company (Prosta spółka akcyjna – P.S.A.) – a modern solution for start-ups

Since 2021, Poland has had the Simple Joint-Stock Company (P.S.A.), a modern legal form created specifically for young, innovative companies. It can be set up with a symbolic capital of PLN 1 and offers flexible participation structures that are attractive to investors and business angels. Incorporation is also possible online, which speeds up the process. The P.S.A. is particularly well-suited to start-ups in technology and innovation. As it is still new, there is less case law to date, but its importance is steadily increasing.

Conclusion: Choosing the right legal form

Selecting the appropriate legal form in Poland depends greatly on individual goals. Those who wish to start quickly and simply often choose a sole proprietorship. Small teams will find a straightforward solution in the general partnership, while the limited partnership offers greater flexibility around liability. For most founders and investors, the Sp. z o.o. remains the first choice—it combines low set-up costs with legal certainty and international acceptance. Those pursuing large capital projects opt for the S.A., while the new P.S.A. opens up entirely new possibilities for start-ups.

International entrepreneurs in particular benefit from Poland’s variety of structures—from lean sole proprietorships to complex corporate entities. To make the optimal choice and avoid pitfalls, it is advisable to seek expert advice before incorporation and to define the company’s long-term objectives clearly.